Semler Scientific follows the path MicroStrategy has first explored: Adding Bitcoin to the treasury to publicly traded company. A massive success that added a significant amount of value to the stock holders.

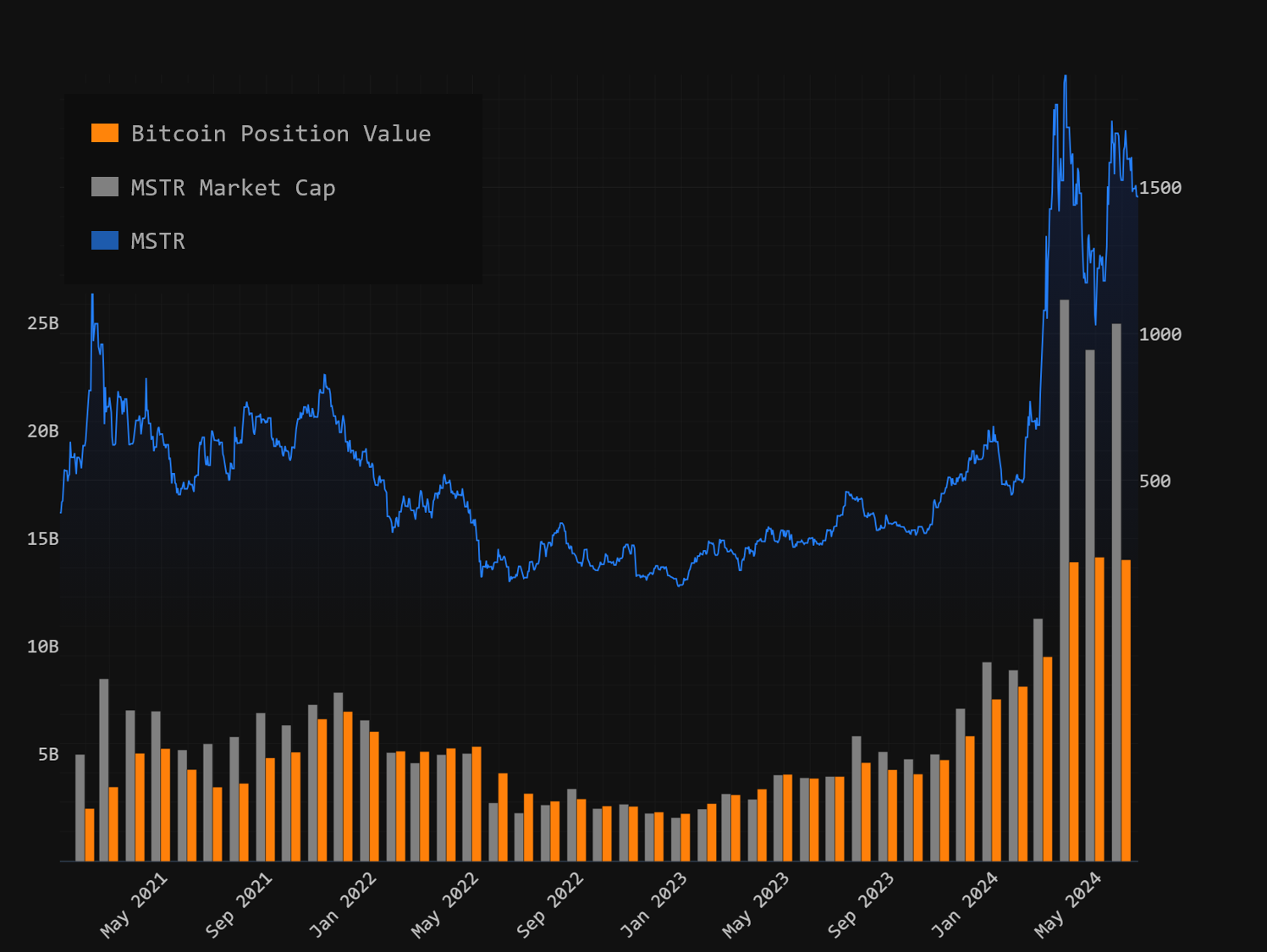

MicroStrategy Market Cap vs Bitcoin Position

MicroStrategy Market Cap vs Bitcoin Position

But why not just buy spot Bitcoin yourself?

If you’re convinced of Bitcoin’s potential, you may want to consider ways to amplify your investment. Taking on debt responsibly to buy more Bitcoin might be one option. However, as a private individual, accessing fixed and low-interest rates can be challenging. One alternative is to invest in Bitcoin proxy stocks, which offer a leveraged play on the Bitcoin price. Publicly traded companies have the ability to issue additional shares and secure debt against their cash flow, providing an attractive option for investors to capitalise on a higher leverage provided by the capital markets. While publicly traded Bitcoin miners may seem like an obvious choice, they are not ideal. They operate in a highly competitive market, with revenue directly tied to the Bitcoin price and heavily dependent on low energy costs. Furthermore, they face disadvantages compared to non-publicly traded mining operations, including other companies and potentially even governments in the future.

So, what makes for a compelling Bitcoin proxy?

- A stable cash flow that allows the company’s Bitcoin treasury to remain untouched for operating expenses even with high volatile swings in the Bitcoin price

- High insider ownership and control of the company

- Demonstrated conviction and understanding of Bitcoin by leaders and board members through public statements and interviews

- Focus solely on Bitcoin, no distractions from any other cryptocurrency

- As a private investor, smaller market capitalization companies can be intriguing options. They are less susceptible to market manipulation by large players, making it easier to manage your investment.

Semler checks all these boxes. They have a very profitable business. They have no debt and a big cash position from their high margin cashflow. They have bought a significant amount of Bitcoin already, around a quarter the size of their market cap at the time of writing. And now they announced they are raising additional capital for the purchase of Bitcoin. Public interviews have shown a deep understanding of Bitcoin. Their first Bitcoin related announcement in June also turned around the momentum of the stock. And the volume shows how thanks to Bitcoin a whole new group of investors have found interest in a company that was difficult to find in the large sea of small companies out there.

Semler Scientific Stock Price

Semler Scientific Stock Price